- Global Custody Pro

- Posts

- US digital asset rules keep easing, what next?

US digital asset rules keep easing, what next?

Global Custody Pro - 12 December 2025

📰 Welcome to the Newsletter

Welcome to Global Custody Pro, read by custody professionals like you. I'm Brennan McDonald, Managing Editor. I write about the global custody industry, having spent over 12 years in financial services, including working at a global custody bank. An AI voice reads the audio version of this newsletter. Reply to this email with feedback or connect with us on LinkedIn.

Table of Contents

Do you enjoy Global Custody Pro? Share it with a colleague today:

🌏 Global Custody News

Northern Trust Wins $385B in New Mandates In 2025

Northern Trust announced it has secured more than 100 new mandates from institutional asset owners globally in 2025, representing over US$385 billion in assets under custody. The Chicago-based custodian said the new business spans pensions, endowments and other institutional investors across North America, Europe, the Middle East, Africa and Asia-Pacific.

The company attributed the growth to its service model and investments in technology platforms for asset owners. Melanie Pickett, head of Asset Servicing Americas, said the firm's client experience model provides "direct access to specialists, consistent service delivery, and strategic engagement." Northern Trust cited its front office solutions platform, which now supports more than $1 trillion in assets, and integrated trading solutions aimed at asset owners insourcing investment management.

Leon Stavrou, head of Australia and New Zealand, noted that superannuation funds in particular are insourcing investment management to gain greater control and efficiency. As of 30 September 2025, Northern Trust reported total assets under custody and administration of US$18.2 trillion and assets under management of US$1.8 trillion.

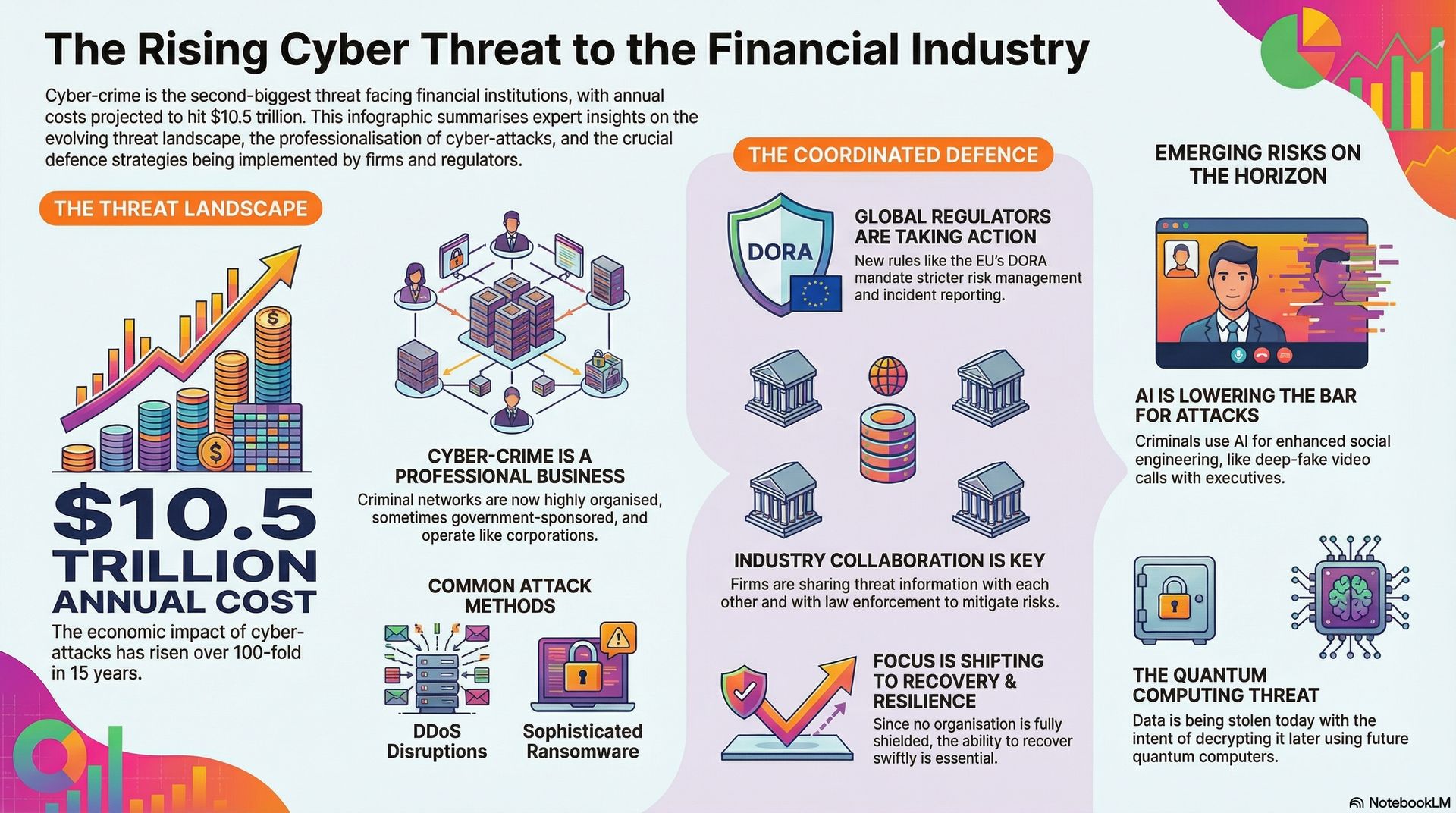

Citi report: cyber-crime costs near $10.5 trillion globally

According to a recently released Citi report, Cyber-crime now ranks as the second-highest concern for financial institutions after geopolitical risk, with global costs estimated at $10.5 trillion and projected to reach $15.63 trillion by 2029, according to a new industry analysis. Nearly half of compromised companies have paid ransoms, with average payments of approximately $5 million for firms with revenues exceeding $1 billion.

Regulatory responses are intensifying across jurisdictions. The SEC adopted rules in 2023 requiring public companies to disclose material cyber incidents within four business days, while the EU's Digital Operational Resilience Act (DORA) and Network and Information Systems Directive 2 (NIS2) seek to harmonise standards. Third-party risk remains acute, with 96% of firms reporting impact from vendor breaches.

Industry experts emphasise that cyber risk differs fundamentally from credit risk in its unpredictability, making resilience and recovery capabilities essential. Institutions are also contending with criminals leveraging artificial intelligence for sophisticated social engineering, while simultaneously developing quantum-resistant encryption methods in anticipation of technological advances expected within the decade.

Citi Wins Nasdaq Post-Trade Mandate

Nasdaq has selected Citigroup's Investor Services division to provide Account Operator Services in the Nordics and Euroclear Bank, the company announced. The mandate enables Nasdaq to outsource post-trade processing and operational functions to Citi's global network and technology infrastructure.

The arrangement provides Nasdaq with immediate harmonised access to relevant Financial Market Infrastructures whilst simplifying operational requirements and converting from a fixed to variable cost structure. Citi is the only bank in the Nordics to offer Account Operator services, according to the announcement. The mandate allows Nasdaq to dedicate resources to client service, transformation and innovation-focused priorities.

Matthew Bax, Head of Sales and Client Services at Citi Investor Services, said the digital-led solutions are creating greater efficiencies for clients and enabling connectivity across the financial ecosystem. Roland Chai, President of Nasdaq Europe, said Citi was the preferred choice as Nasdaq sought to gain efficiencies across post-trade activities through harmonised solutions and innovation.

Deeper PFMI insights, all in one place.

Our proprietary database of PFMI quantitative disclosures now covers 46 FMIs with selective historical depth. Coupled with our custom analytics and calculated measures, it enables sharper, more meaningful comparisons across global FMIs. If this capability aligns with your needs, contact [email protected] to discuss further.

🚀 Digital Asset News

OCC Approves Bank Crypto-Asset Principal Trading

The Office of the Comptroller of the Currency confirmed in Interpretive Letter #1188, dated 9 December 2025, that national banks have the authority to engage in riskless principal transactions involving crypto-assets. In such transactions, a bank purchases a crypto-asset from one counterparty for immediate resale to another counterparty, with execution occurring effectively simultaneously and the bank holding no inventory except in rare settlement defaults. The OCC stated the activity is permissible under the "business of banking" powers clause in 12 U.S.C. § 24(Seventh), applying to both crypto-assets that are securities and those that are not securities.

The interpretive letter, signed by Adam J. Cohen, Senior Deputy Comptroller and Chief Counsel, concluded that the activity is functionally equivalent to recognised bank brokerage activities and represents a logical outgrowth of crypto-asset custody services that national banks may already provide. The regulator noted that banks acting as riskless principals face primarily counterparty credit risk rather than market risk, similar to risks in securities transactions and perfectly-matched derivative transactions. The OCC stated that offering riskless principal crypto-asset transactions would benefit customers by providing access to crypto-asset services through highly regulated banks rather than unregulated or less regulated options.

The determination requires banks to conduct riskless principal crypto-asset transactions in a safe and sound manner and in compliance with applicable law. The OCC stated it would examine such activities as part of its ongoing supervisory process. The regulator noted that state banks have long engaged in riskless principal transactions with respect to securities, and whilst state regulatory frameworks concerning crypto-asset activities by state banks continue to develop, none expressly prohibit such transactions.

Standard Chartered partners GFO-X on digital custody

Standard Chartered and GFO-X, operator of the UK's first FCA-regulated and centrally cleared digital asset derivatives trading venue, announced a partnership to provide collateral management and custodian services for digital assets to support the development of GFO-X Abu Dhabi CCP Limited. Under the arrangement, institutional clients will be able to utilise cryptocurrencies, tokenised money market funds, and other forms of digital assets as collateral for trading in a fully centrally cleared and credit intermediated model, with Standard Chartered acting as an independent, regulated custodian.

The partnership follows GFO-X Abu Dhabi's receipt of In-Principle Approval from the Financial Services Regulatory Authority of ADGM in September 2025 to operate as a Recognised Investment Exchange and a Recognised Clearing House for digital assets and related derivatives. That approval has recently been extended to include securities and ETFs. Arnab Sen, CEO and Co-Founder of GFO-X, said the partnership would "unlock a significant amount of pent-up demand for trading" in a highly regulated and cleared trading venue.

The companies stated that go-live is expected in the second half of 2026. Margaret Harwood-Jones, Global Head of Financing and Securities Services at Standard Chartered, said the partnership demonstrates "how trusted institutions can help shape a secure and scalable market structure" combining custody with central clearing and credit intermediation to enhance risk management across the digital asset ecosystem.

CFTC Launches Digital Assets Pilot Program

The Commodity Futures Trading Commission launched a digital assets pilot program allowing registered futures commission merchants to accept bitcoin, ether, and USDC as customer margin collateral in derivatives markets. Acting Chairman Caroline D. Pham announced the initiative, which includes new guidance on tokenized collateral and establishes a three-month initial period during which participating firms must provide weekly reporting to CFTC staff. The announcement follows Pham's September tokenized collateral initiative as part of the CFTC's implementation of recommendations in the President's Working Group on Digital Asset Markets report.

The CFTC's Market Participants Division issued a no-action position providing regulatory clarity on application of segregation and capital requirements to futures commission merchants accepting non-securities digital assets as margin collateral. The guidance applies to tokenized real-world assets including U.S. Treasury securities and money market funds, and addresses eligible tokenized assets, legal enforceability, custody arrangements, and operational risks. The regulator simultaneously withdrew Staff Advisory No. 20-34, which placed restrictions on futures commission merchants' ability to accept virtual currencies as customer collateral, stating the advisory had become outdated following passage of the GENIUS Act.

Industry executives including Paul Grewal, Coinbase Chief Legal Officer, and Heath Tarbert, President of Circle, said the guidance provides regulatory certainty for digital assets in derivatives markets. The no-action position requires participating futures commission merchants to notify CFTC staff promptly of any significant issues during the pilot period, providing the agency an opportunity to monitor developments associated with non-securities digital asset collateral whilst maintaining robust risk management practices.

Are you happy with today's digital asset section? |

How was today's newsletter? |

© Global Custody Pro. Published by Digital Content Operations LLC. All Rights Reserved.