- Global Custody Pro

- Posts

- AI in Clearing and Settlement

AI in Clearing and Settlement

How market infrastructure is using artificial intelligence to manage compressed settlement cycles

This is the third instalment in our new series for Q1 2026. The first article, “The Complete 2026 Guide to AI in Global Custody”, achieved some of our highest email engagement ever. If implementing AI is part of your KPIs this year - share this email with a colleague now so they’re on the same page. We only grow through word of mouth and referrals.

Table of Contents

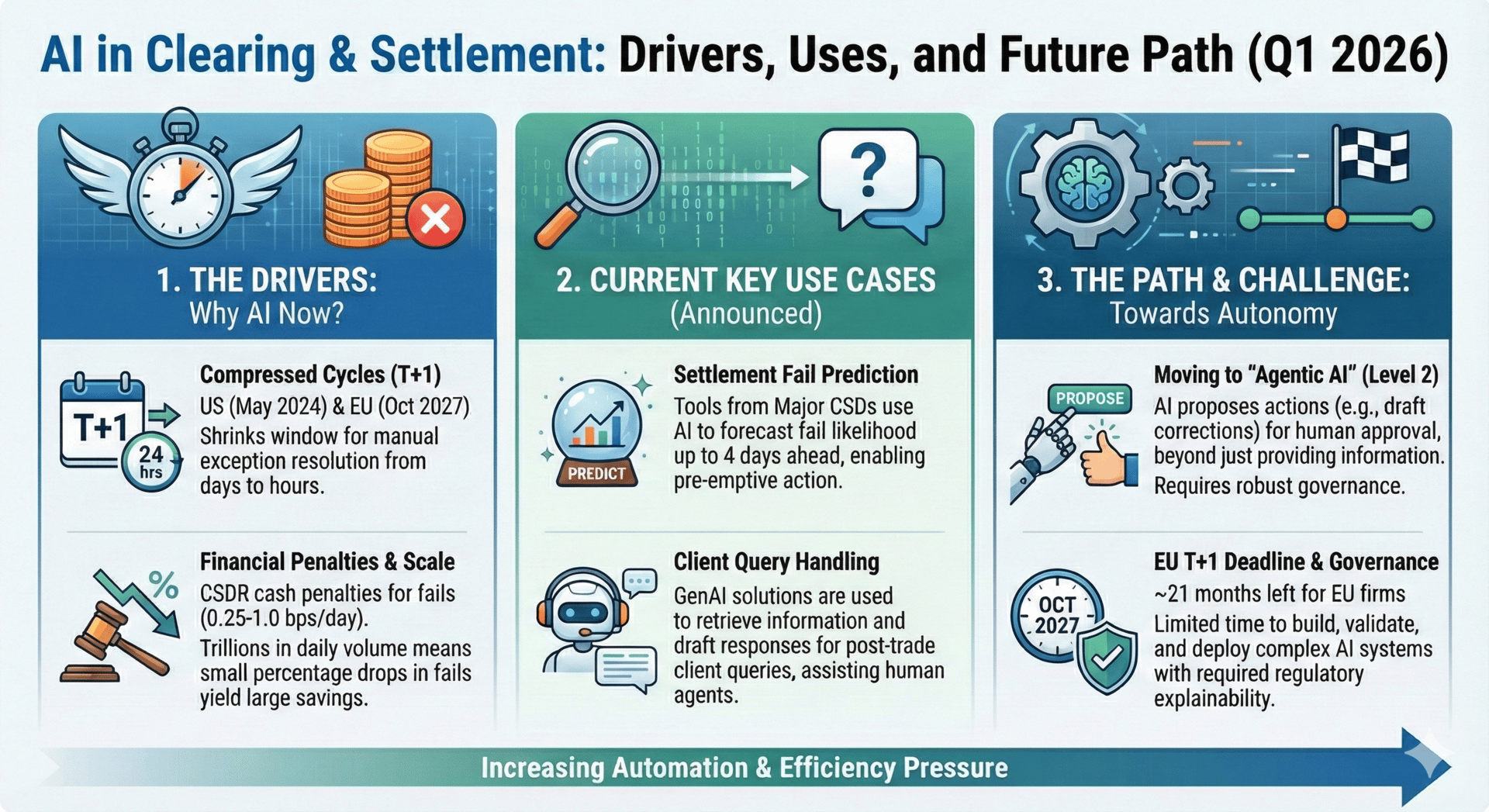

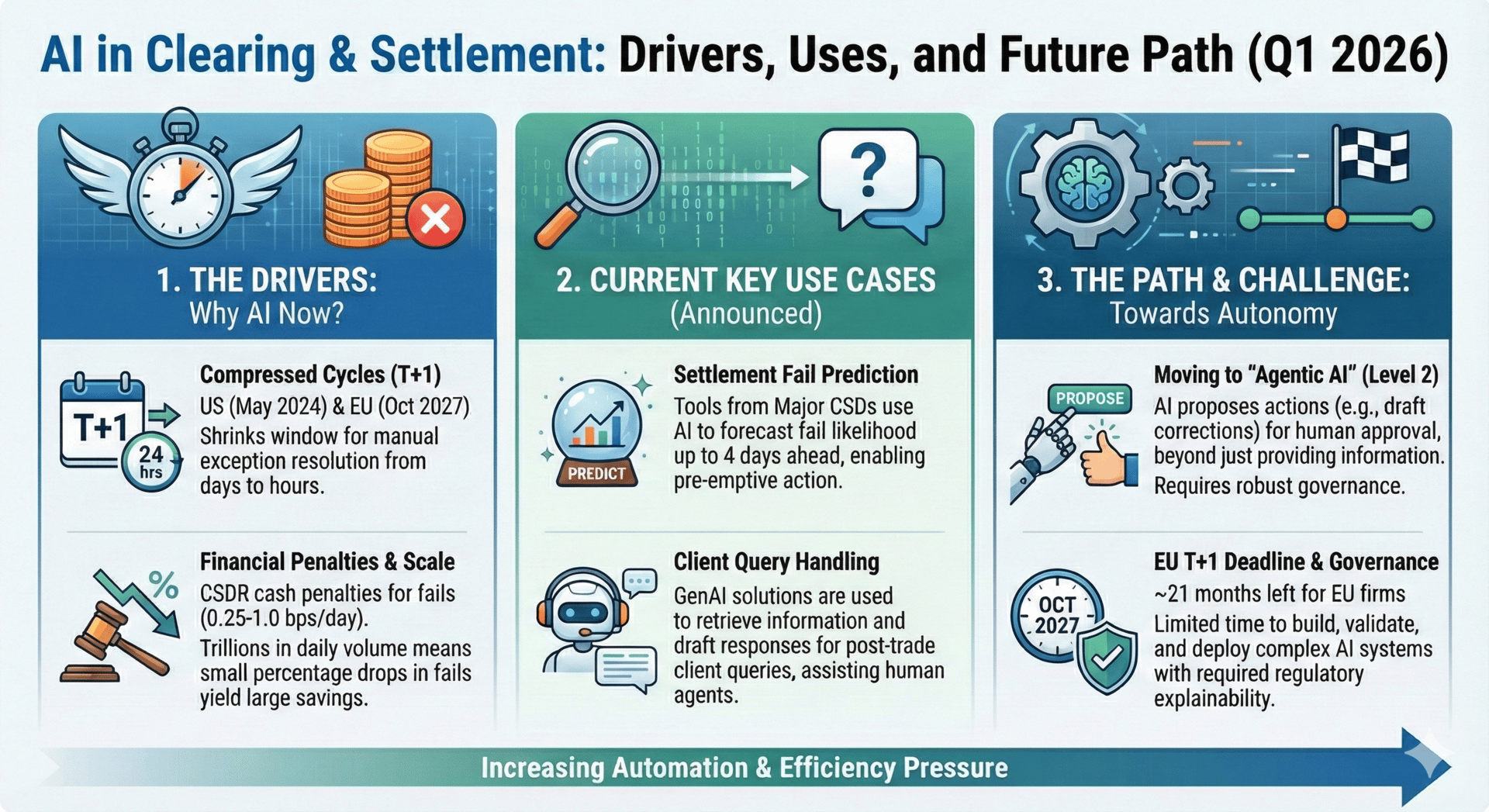

Based on company disclosures from 2024 and 2025, AI in clearing and settlement now includes production deployments in specific functions. As of January 2026, European market participants have roughly 21 months before the EU moves to T+1 settlement on 11 October 2027. The United States made this shift on 28 May 2024, cutting the window for exception resolution from two days to one. According to the SIFMA/ICI/DTCC After Action Report, same-day affirmation rates for institutional equity trades in DTC scope improved from 73% to roughly 95%. Yet CNS settlement fail rates, as reported in the same document, stay at roughly 2% to 3%. Settlement fails for in-scope transactions can incur CSDR cash penalties of 0.25 to 1.0 basis points per day.

The question is whether AI will matter in your post-trade operations before T+1 makes current exception-handling methods untenable. Building prediction models, linking them to legacy systems, training operations teams, and setting up governance takes time. Firms starting now can still choose their approach; firms starting in late 2026 are more likely to accept constraints set by vendors, scope limits, or interim workarounds.

This guide reviews disclosed deployments at DTCC, Clearstream, Euroclear, CME, and LSEG based on company announcements and regulatory filings. It separates what companies have announced from what remains speculative. And it provides a framework for assessing where AI could add value in your operations. For broader context on how custodians are approaching AI across all functions, see our companion guide: The Complete Guide to AI in Global Custody.

A note on method: This guide relies on publicly available company disclosures, press releases, and regulatory filings. We have not independently verified these deployments. Where companies have announced capabilities, we report what they have claimed; where evidence is unavailable, we say so.

Why AI in Clearing and Settlement Matters

Three forces have made AI adoption increasingly relevant for clearing and settlement operations. The pressures differ somewhat for central counterparties (focused on margin and default management), central securities depositories (focused on settlement efficiency), and their participants (focused on exception handling and funding). But the underlying drivers affect all segments.

Compressed settlement cycles. The US moved to T+1 on 28 May 2024. The EU confirmed T+1 for 11 October 2027, with political agreement reached in June 2025 and publication in the EU Official Journal in October 2025. Each compression shrinks the window for manual exception resolution. What previously allowed overnight investigation now requires same-day action.

Penalty regimes with financial consequences. The CSDR settlement discipline regime, in effect since February 2022, imposes daily cash penalties for settlement fails on in-scope transactions. Rates range from 0.25 basis points for sovereign bonds to 1.0 basis point for liquid equities. According to ESMA data, fail rates by value have roughly halved since the regime took effect, from around 6.6% in January 2022 to roughly 3.8% by early 2024. While 81% of individual penalties are under EUR 50, total costs for large participants can be material.

Volume at scale. According to its 2024 Annual Report, DTCC holds roughly USD 85 trillion in securities and processes transactions valued at roughly three quadrillion dollars annually. The FICC Government Securities Division alone handles over USD 10 trillion in daily activity. At this scale, even small percentage drops in fail rates mean large reductions in operational cost, capital needs, and counterparty risk.

Terminology: Throughout this guide, a settlement fail refers to a settlement instruction that does not complete on the intended settlement date. This may occur at the instruction level (a single delivery or receipt) or be grouped at the trade level depending on context. Fail rates cited from DTCC sources refer to CNS (Continuous Net Settlement) and Non-CNS instruction populations as specified in the After Action Report.

Order-of-Magnitude Illustration: The Cost of Settlement Fails (Hypothetical) A firm settling EUR 10 billion daily with a 3% fail rate experiences EUR 300 million in daily fails. At 0.5 bp average penalty rate, daily penalties could reach EUR 15,000. Over 250 trading days, annual penalty exposure could approach EUR 3.75 million. A prediction tool that cuts fails by 30% could cut this exposure by the same amount. This uses hypothetical figures for illustration only. Actual exposure depends on asset mix, counterparty profile, instruction value, and resolution speed. Penalty rates vary by asset class. |

Key Use Cases

Based on company announcements and logical inference from current pain points, several areas show potential for AI. The first two have announced deployments; the latter two are logical extensions that have not been publicly disclosed.

Settlement Fail Prediction

The most commonly announced AI use case in settlement is predicting which instructions are likely to fail before the settlement date. According to a July 2025 press release, Clearstream enhanced its Settlement Prediction Tool to provide predictions up to four business days in advance. The company states the tool provides settlement likelihood scores, root cause attribution, and estimated penalty costs. Euroclear announced the launch of EasyFocus+ in June 2025 with similar stated capabilities: matching scores, matching quantiles, root cause analysis, and CSDR penalty predictions.

The value is straightforward: if operations teams know which instructions are at risk, they can act before the settlement window closes. In a T+1 setting, this shifts from useful to essential. Neither Clearstream nor Euroclear has disclosed accuracy metrics, false positive rates, or precision/recall figures for their prediction models.

Client Query Handling

A large part of post-trade operations involves responding to client queries about settlement status, fails, and corporate actions. According to an AWS case study published in January 2025, LSEG deployed Amazon Q Business for post-trade client services, using a retrieval-augmented generation setup to answer queries across OTC rates, listed rates, fixed income, FX, CDS, and equities. The case study states the system uses Amazon Bedrock and Anthropic Claude to generate responses based on internal documentation.

This use case shows the stated application of generative AI to cut the burden on client service teams. The limit is that these systems answer questions but do not take actions: they operate at Level 1 autonomy, assisting human decision-making without executing changes. How well they work depends on the quality and consistency of underlying data and procedures.

Liquidity Sourcing and Positioning (Potential Application)

No market infrastructure operator has publicly disclosed AI-driven liquidity sourcing for settlement. However, the logic is clear: if a model can predict which instructions will fail due to insufficient securities or cash, it could also propose sourcing actions. An agent might identify a projected shortfall, query available inventory across accounts, propose a securities lending transaction or internal transfer, and present the solution for human approval.

No confirmed deployments exist. The complexity lies not only in technical integration but in control needs: approval workflows, audit trails, and segregation of duties. Any system proposing funding transactions would need governance comparable to existing treasury controls.

Netting Optimisation (Potential Application)

Multilateral netting reduces settlement obligations by offsetting buy and sell positions across participants. According to the SIFMA/ICI/DTCC After Action Report, NSCC Clearing Fund requirements fell by USD 3.0 billion (23%) following T+1, partly due to shorter exposure windows. No CCP or CSD has disclosed AI-driven netting optimisation, but the mathematical nature of the problem (finding optimal offsets across thousands of positions) is well suited to algorithmic approaches.

A potential application would be AI that identifies additional netting opportunities within existing constraints, or that sequences settlement instructions to maximise netting efficiency within a settlement cycle. Constraints may include risk limits, legal entity boundaries, and cut-off times. No public disclosures confirm such deployments.

Dictate prompts and tag files automatically

Stop typing reproductions and start vibing code. Wispr Flow captures your spoken debugging flow and turns it into structured bug reports, acceptance tests, and PR descriptions. Say a file name or variable out loud and Flow preserves it exactly, tags the correct file, and keeps inline code readable. Use voice to create Cursor and Warp prompts, call out a variable like user_id, and get copy you can paste straight into an issue or PR. The result is faster triage and fewer context gaps between engineers and QA. Learn how developers use voice-first workflows in our Vibe Coding article at wisprflow.ai. Try Wispr Flow for engineers.

What Market Infrastructure Operators Have Announced

The major market infrastructure operators have disclosed varying levels of AI investment. What follows summarises their public announcements from 2024 and 2025. We have not independently verified these claims.

DTCC. The 2024 Annual Report describes an AI Council and AI Enablement Team to coordinate strategy, deployment of over 300 online AI courses for employees, and a four-pillar AI strategy covering productivity, client experience, risk mitigation, and research. DTCC reported net income of USD 482 million for 2024 and total revenue of USD 2.486 billion. The report does not disclose specific AI-driven productivity metrics or accuracy rates.

Clearstream. According to a July 2025 press release, Clearstream (Deutsche Boerse) enhanced its Settlement Prediction Tool to provide predictions up to four business days ahead, available through the Xact Web Portal. No accuracy metrics have been disclosed.

Euroclear. A June 2025 press release announced EasyFocus+ in partnership with Microsoft, Meritsoft (Cognizant), and Taskize, targeting improvement from 65% to 99% trade date matching. A separate Q1 2025 announcement described a seven-year partnership with Microsoft covering cloud, data, and AI. Investment amounts have not been disclosed.

LSEG/LCH. According to an AWS case study published in January 2025, LSEG deployed Amazon Q Business for post-trade client services, using a retrieval-augmented generation setup with Amazon Bedrock and Anthropic Claude.

CME Group. The February 2025 10-K filing describes SPAN 2, a VaR-based margin methodology deployed for energy products in Q3 2023, extended to equities in September 2024, and scheduled for agricultural products in H2 2025. The filing does not explicitly reference AI or machine learning in clearing operations beyond these risk management enhancements.

What these announcements suggest: Market infrastructure operators are investing in data and AI programs, with announced deployments concentrated in prediction and client-service knowledge retrieval. What they do not reveal: accuracy rates, false positive rates, or measured operational impact. This opacity could reflect competitive sensitivity, early-stage deployment, or results that do not yet justify public claims. For practitioners, these announcements should be treated as directional rather than definitive.

The Path to Autonomy: Agentic AI

The announced deployments operate mainly at Level 0 to Level 1 on the autonomy spectrum: humans perform tasks with AI providing information or recommendations. The question is whether and when clearing and settlement operations will move to higher autonomy levels. For a full treatment of the agentic AI spectrum and its implications for financial services, see our forthcoming guide: Agentic AI in Securities Services.

Level 0 (Manual): Human performs task without AI assistance. This remains the default for most exception handling.

Level 1 (Assisted): AI provides recommendations; human decides and executes. The Clearstream and Euroclear prediction tools, as described in their announcements, would operate here.

Level 2 (Augmented): AI proposes specific actions; human approves; system executes. This is where exception resolution could move with appropriate guardrails. A Level 2 system might gather evidence on a predicted fail, identify the root cause, draft a counterparty message or SSI correction, and queue the action for human approval.

Levels 3-4 (Supervised to Autonomous): At Level 3, AI executes within defined boundaries while humans monitor and handle exceptions. At Level 4, AI operates independently with human oversight of outcomes only. Both remain unlikely in the near term for critical market infrastructure given systemic importance and regulatory expectations around accountability and explainability.

The constraint on higher autonomy is not mainly technical but systemic. CCPs and CSDs are systemically important financial market infrastructures. Regulators require robust governance, clear accountability, and the ability to explain decisions. BIS Working Paper 1194, published in June 2024, identifies specific risks: herding behaviour if multiple institutions use similar models, concentration risk in AI providers, and lack of explainability in complex models. These concerns apply directly to clearing and settlement.

The more likely path is gradual expansion of Level 2 capabilities: AI agents that investigate exceptions, propose resolutions, and prepare actions for human approval. This approach maintains human accountability while cutting the manual burden of investigation. Firms that develop effective Level 2 systems will have optionality to move toward Level 3 as regulatory comfort and model performance improve.

What We Still Don't Know

Intellectual honesty requires acknowledging the limits of available evidence. The following questions cannot be answered from public disclosures:

Prediction accuracy. Neither Clearstream nor Euroclear has disclosed accuracy rates, false positive rates, or precision/recall metrics for their settlement prediction tools. Without this data, it is not possible to assess operational value or compare approaches.

Return on investment. No market infrastructure operator has disclosed the cost of AI development or the operational savings achieved. Business cases remain unverified.

Regulatory stance. ESMA has not published guidance on AI governance for CSDs. It is unclear whether regulators will require explainability, validation, or approval for AI systems in critical settlement functions.

Cross-border interoperability. With DTCC, Euroclear, and Clearstream each developing proprietary AI tools, no data exists on whether these systems can share predictions or learnings across jurisdictions.

Agentic deployments. No market infrastructure operator has publicly disclosed AI agents that take actions (Level 2 or above) in production settlement operations. Announced deployments are assistive, not agentic.

Liquidity and netting AI. The potential applications described above for liquidity sourcing and netting optimisation are logical inferences, not confirmed deployments. Treat them as hypotheses requiring validation.

Independent verification. We have not independently verified any of the deployments described in this guide. Our account is based on company disclosures.

Questions for vendor and infrastructure due diligence:

What is your false positive rate, and how is it measured?

What is your model drift monitoring approach?

What happens when the model is wrong, and how are corrections handled?

Can you provide backtested precision and recall by fail reason?

What training data was used, and how is it refreshed?

How do you handle regime changes such as T+1 transitions?

Implementation Challenges

Several barriers complicate AI adoption in clearing and settlement.

Data quality across counterparties. Prediction models are only as good as their inputs. Settlement involves multiple parties, each with their own data systems, formats, and quality standards. A model trained on one CSD's data may not transfer well to another jurisdiction or asset class.

Legacy system integration. Market infrastructure operates on systems built over decades, often with mainframe cores and complex integration layers. Deploying AI models that can access real-time data and trigger downstream actions requires significant architectural investment.

Risk-averse culture. Operations professionals in clearing and settlement are trained to be cautious. Settlement finality is a legal concept with real consequences. Introducing AI that might occasionally produce incorrect recommendations creates cultural friction, even if overall accuracy exceeds human performance.

Governance for critical infrastructure. CCPs and CSDs operate under regulatory frameworks that require clear accountability. Model risk management requirements, including those in US Federal Reserve SR 11-7 guidance, extend to AI systems. Explainability, validation, and ongoing monitoring are prerequisites, not afterthoughts.

Getting Started

For operations leaders considering AI investment in clearing and settlement, several diagnostic questions can clarify priorities.

Where are settlement fails concentrated? If 80% of fails come from 20% of counterparties or securities, prediction models can be trained on high-impact segments first.

What is your current false positive rate? If existing rules-based systems generate thousands of exceptions with low true positive rates, AI-based classification can cut the noise. According to State Street disclosures, its Alpha AI Data Quality capability cut exceptions from 31,000 to 4,000 while catching 100% of genuine issues in custody operations. Similar gains may be possible in settlement, though we have not verified this claim.

Do you control your operations? Third-party outsourcing arrangements create friction for AI deployment. You cannot easily change processes you do not own. State Street's stated decision to insource operations previously outsourced reflects this logic.

What is your governance framework? AI systems require validation, monitoring, and clear escalation protocols before production deployment. Building this infrastructure is a prerequisite, not an afterthought.

Where are you on the autonomy spectrum? Most organisations are at Level 0-1. The path to Level 2 requires investment in both technology and change management. Start by mapping your current state.

Applying the 5C Adoption Friction Framework

AI adoption friction in clearing and settlement typically stalls on one of five points. Identifying which one is blocking your initiative determines the intervention.

Clarity: Do operations teams understand what the AI will do? BIS Working Paper 1194 identifies lack of explainability as a systemic risk in AI deployments. If model governance cannot explain the prediction logic, operations teams will treat outputs as a black box. The friction is not resistance; it is reasonable uncertainty.

Capability: Do teams have the skills to act on AI outputs? DTCC's reported deployment of over 300 AI courses is consistent with capability building being a prerequisite, not an afterthought. Prediction tools are useless if the team receiving the output cannot investigate, validate, or act on it.

Credibility: Do teams trust the model? Neither Clearstream nor Euroclear has disclosed accuracy metrics for their settlement prediction tools. Without false positive rates or precision data, operations teams have no data-based reason to trust. Years of rules-based systems generating thousands of false exceptions have created justified scepticism.

Control: Do teams feel agency over the change? State Street's stated decision to insource operations reflects a harder truth: you cannot deploy AI on processes you do not control. Third-party arrangements, rigid vendor contracts, or centralised AI teams that bypass operations leadership all reduce perceived control and increase friction.

Consequences: Do teams see personal benefit? No market infrastructure operator has disclosed ROI or headcount impact from AI deployment. If leadership cannot explain what success looks like for the operations team (not just the P&L), adoption stalls. The question "what happens to my role?" remains unanswered.

Most AI initiatives are not stuck because of technology. They are stuck on one of these five friction points. Diagnosing which one is the first step toward movement.

The AI Change Leadership Intensive For post-trade operations leaders implementing AI-enabled change: the Intensive uses the 5C Adoption Friction Model to identify which friction point is blocking your initiative, and the specific moves that would shift your first resistant group to active adoption within 90 days. |

What's Next

The EU T+1 transition date of 11 October 2027 provides a hard deadline. As of January 2026, European market participants have roughly 21 months to achieve operational efficiency comparable to what US firms have been building since May 2024. This is limited time to design, build, validate, and deploy sophisticated AI systems from scratch.

The open questions concern regulatory stance and competitive dynamics. Will ESMA provide guidance on AI governance for CSDs? Will CCPs begin disclosing AI-driven risk management capabilities as a differentiator? Will infrastructure operators share prediction data across jurisdictions to improve model performance? And will the compressed timelines of T+1 create sufficient pressure to push organisations from Level 1 to Level 2 autonomy?

The infrastructure exists to make clearing and settlement more intelligent. What remains to be built is the operational confidence to use it, and the governance frameworks that regulators and boards require.

Three questions for your organisation: What is your current settlement fail rate, and what would a 50% reduction be worth in penalty savings and operational cost? Do you have the governance framework to deploy AI in production settlement operations? And is your operations team ready to supervise AI agents, or are they still expecting to be the first line of defence?

I write about AI adoption at brennanmcdonald.com. If you found this useful, subscribe to my newsletter for weekly insights on AI transformational change.

Sources

Primary Sources

SIFMA, ICI, and DTCC, "T+1 After Action Report," 12 September 2024

DTCC, "2024 Annual Report," 2024

European Commission, "A Shorter Settlement Cycle," Directorate-General for Financial Stability, Financial Services and Capital Markets Union, 3 July 2025

Council of the European Union, "Securities Trading: Council and Parliament Agree on Shorter Settlement Cycle," press release, 18 June 2025.

ESMA, "Final Report: Technical Advice on the CSDR Penalty Mechanism," ESMA74-2119945925-2059, November 2024.

Bank for International Settlements, "Intelligent Financial System: How AI is Transforming Finance," Working Paper No. 1194, June 2024.

Corporate Disclosures (Not Independently Verified)

CME Group, "Form 10-K Annual Report," filed February 2025. Key data: SPAN 2 implementation timeline

Clearstream, "Clearstream Enhances its Settlement Prediction Tool," press release, July 2025.

Euroclear, "Euroclear Teams with Meritsoft and Taskize to Launch Next Generation AI Service," press release, June 2025.

Euroclear, "Euroclear and Microsoft Announce Seven-Year Partnership," press release, Q1 2025.

Amazon Web Services, "London Stock Exchange Group Uses Amazon Q Business to Enhance Post-Trade Client Services," case study, January 2025.

State Street, company disclosure on Alpha AI Data Quality, 2025.

Mostapha Tahiri (EVP and COO, State Street), remarks at Fortune COO Summit, June 2025.

Glossary

Domain Terms

Affirmation: The process by which counterparties confirm the details of a trade, typically required before settlement can proceed.

Central Counterparty (CCP): An entity that interposes itself between counterparties to trades, becoming the buyer to every seller and the seller to every buyer.

Central Securities Depository (CSD): An institution that holds securities in dematerialised form and processes the transfer of ownership.

Clearing: The process of establishing what is owed between counterparties after a trade executes, including calculating net obligations.

CSDR (Central Securities Depositories Regulation): EU regulation governing CSDs, including the settlement discipline regime that imposes cash penalties for settlement fails.

Delivery versus Payment (DVP): A settlement mechanism ensuring securities transfer occurs if and only if the corresponding payment occurs.

Settlement Fail: A settlement instruction that does not complete on the intended settlement date. May be measured at instruction level or grouped at trade level.

Netting: The process of offsetting buy and sell obligations to reduce the number and value of movements required for settlement.

Novation: The process by which a CCP replaces the original trade, becoming the counterparty to both buyer and seller.

Settlement: The exchange of securities for cash that completes a transaction.

T+1: A settlement cycle where transactions settle one business day after the trade date.

Agentic AI Terms

Agentic AI: AI systems that can reason, plan, use tools, and take actions with minimal human oversight. Unlike assistive AI that provides recommendations, agentic AI can complete multi-step tasks within defined guardrails.

AI Agent: A software system that uses AI to perceive its environment, make decisions, and take actions to achieve goals.

Autonomy Level: The degree of independence an AI system has to make decisions and take actions, ranging from Level 0 (fully human-controlled) to Level 4 (fully autonomous).

Guardrails: Constraints and boundaries that limit what an AI agent can do, such as transaction value limits or mandatory escalation triggers.

Human-in-the-Loop: An AI design pattern where humans review and approve AI decisions before execution.

Tool Use: The ability of an AI agent to interact with external systems, APIs, and data sources to complete tasks.

Article prepared January 2026. All figures as at most recent available disclosure unless otherwise noted. Illustrative calculations are hypothetical and should not be relied upon for business decisions. Deployments described are based on company disclosures and have not been independently verified.