- Global Custody Pro

- Posts

- Global Custody Pro: 2025 Year in Review

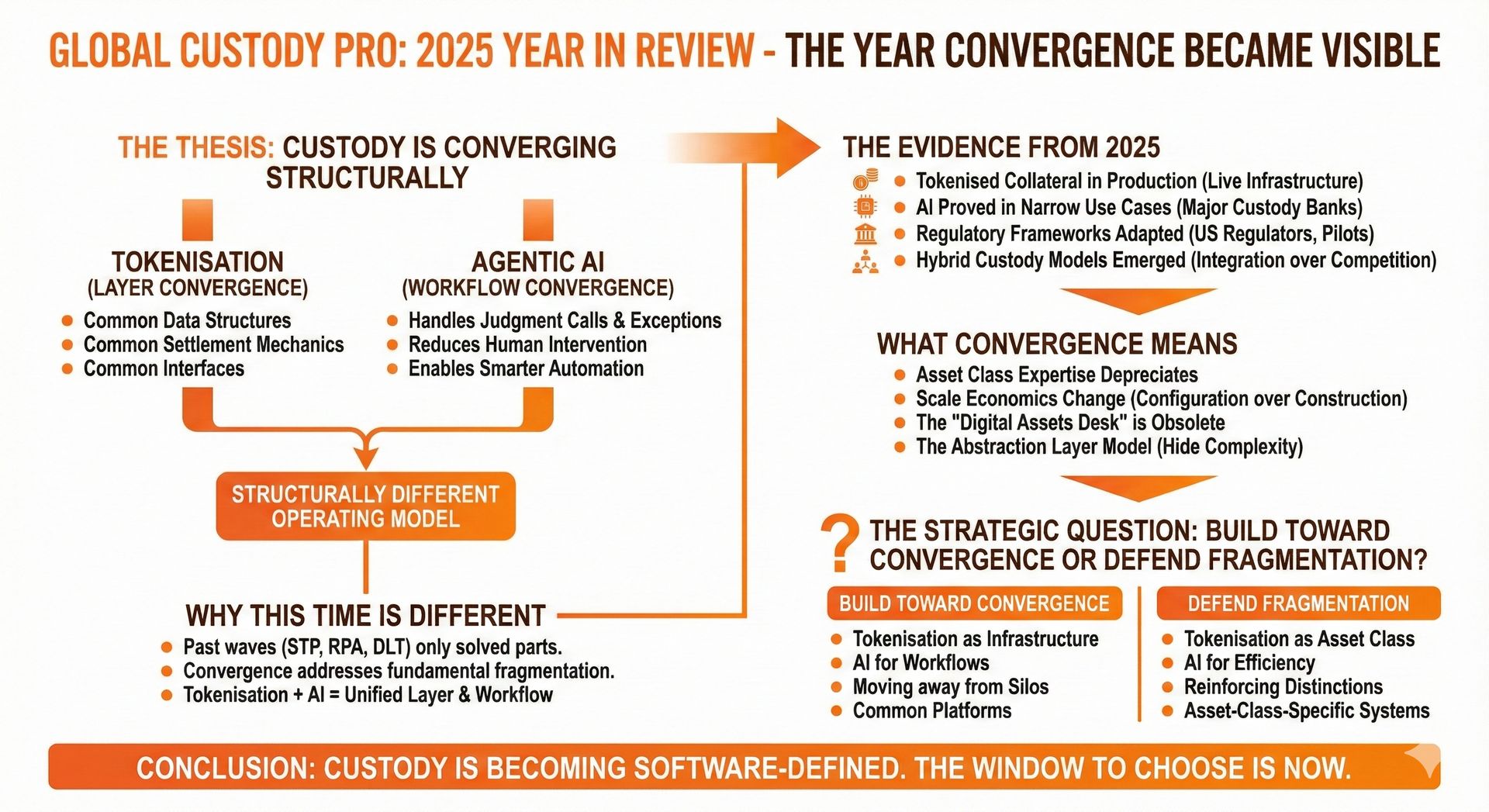

Global Custody Pro: 2025 Year in Review

The Year AI & Tokenised Asset Convergence Became Visible

📰 Welcome to the Newsletter

Welcome to Global Custody Pro, read by custody professionals like you. I'm Brennan McDonald, Managing Editor. I write about the global custody industry, having spent over 12 years in financial services, including working at a global custody bank. This is the last Global Custody Pro edition for 2025. Thanks for your support this year. Reply to this email with feedback or connect with us on LinkedIn.

Table of Contents

The thesis: this time it’s actually different

Custody is converging. Not bit by bit, but structurally.

For decades, the industry has been organised around asset class distinctions. Equities settle differently from bonds. Funds need different handling from derivatives. Each asset class has its own teams, systems, and expertise. This fragmentation reflects genuine differences in how these assets behave.

That fragmentation is ending. Two forces are combining to collapse the operational distinctions between asset classes, and 2025 is the year this became visible.

Tokenisation is creating a common layer: different assets represented in common data structures, settling through common mechanics, held through common interfaces. Agentic AI will enable workflow convergence: the judgment calls and exception handling that keep humans in the loop will be handled as AI capability rises.

Neither force alone achieves this. Tokenisation without AI agents gives you a new layer but still requires humans for exceptions. AI agents without tokenisation give you smarter automation of fragmented processes. Together, they enable a structurally different operating model.

A note on timing: 2025 is not the year convergence happened. It is the year the pieces started fitting together. Tokenisation reached production in specific use cases. AI moved from experiment to approved deployment in narrow areas. The mechanism became visible. The full transformation is years away.

Why previous automation failed

The custody industry has heard transformation promises before. Each previous wave attacked one part of the problem. None solved the fundamental fragmentation.

Straight-through processing automated the happy path. A trade that matched cleanly could settle without human intervention. But the exception rate in custody is high. Every failed trade, every corporate action, every data mismatch required human judgment. STP captured the routine work. The exceptions still needed people.

Robotic process automation promised to capture what STP missed. RPA could handle repetitive tasks: extracting data, copying between systems, generating reports. The robots proved brittle. When formats changed or edge cases appeared, they broke. RPA cut headcount in specific functions but did not change the operating model.

Distributed ledger technology offered a better layer. Shared ledgers could eliminate reconciliation. Smart contracts could automate corporate actions. But technology alone does not drive adoption. Without network effects, a better layer remains a pilot.

Early AI tools have been deployed for specific tasks: document processing, anomaly detection, code assistance. Useful, but incremental. They make existing processes faster without changing what those processes are.

The pattern: each technology addressed one constraint while leaving others intact. Fragmentation survived because different asset classes genuinely required different handling.

Why custody is hard to automate

Custody looks simple from outside: hold assets, process transactions, send reports. The complexity is in the exceptions.

A corporate action arrives with ambiguous terms. A trade fails for reasons no one anticipated. A client instruction could be read three ways. A regulation changes and no one knows how it applies.

These exceptions are not rare. A meaningful share of custody activity requires human judgment (business decisions on T+1 programs, interpreting Russian sanctions…). Previous automation handled the routine work and left the judgment calls. That is why headcount never fell as much as the technology promised.

Why this time is different

For convergence to happen, you need both layer convergence and workflow convergence occurring together.

Layer convergence is what tokenisation provides. When equities, bonds, and funds are all represented as tokens on programmable ledgers, they share common data structures, common settlement mechanics, and common custody interfaces. The operational differences between asset classes shrink. Not because a bond becomes an equity, but because the handling becomes the same.

Today, a custodian needs different teams and systems for each asset class. If those assets share a common layer, those distinctions become unnecessary overhead.

Workflow convergence is what agentic AI can provide. But we need to be honest about where the industry is today. Most custodians are using AI in narrow, approved use cases: document processing, code assistance, specific client service tasks. Broad deployment of AI agents handling exceptions and judgment calls across operations is not happening yet. The governance frameworks do not exist. The liability questions are unresolved. The technology is promising; the organisational readiness is not there.

What changed in 2025 is that the path became clearer. Agentic AI can reason about ambiguous situations, plan multi-step solutions, and execute with minimal oversight. Not perfectly. Not without supervision. But well enough that, once governance catches up or competitive pressure becomes too strong, the human role can shift from doing the work to reviewing what the agent proposes and deciding whether to approve it.

The combination is what matters. Tokenisation provides a uniform layer. Agentic AI provides the ability to manage that layer without asset-class-specific human expertise. Neither is fully deployed today. But both are now past the proof-of-concept stage.

Where AI actually is in custody today

The gap between vendor promises and operational reality is wide.

What is happening: AI tools deployed for specific approved tasks. Document extraction. Code generation. Drafting routine communications. Anomaly flagging.

What is not happening: AI agents handling exceptions autonomously. AI making judgment calls on client instructions. AI resolving failed trades without human sign-off.

The constraint is not technology. It is governance. Custody involves fiduciary duties and regulatory obligations. Deploying AI that makes decisions creates liability questions no one has answered. Until the governance frameworks exist, AI in custody will remain narrow.

The 2025 shift: the narrow deployments are working. The technology is proving itself in controlled conditions. The question is no longer "can AI do this?" but "how do we govern AI doing this at scale?"

The evidence from 2025

Several developments signal that convergence is becoming plausible.

Tokenised collateral reached production. Protocols now allow institutions to use tokenised money market funds as collateral without moving the assets. This is live infrastructure. If it works for money market funds, it can work for other asset classes. The layer is extensible.

AI proved itself in narrow use cases. Major custody banks deployed AI across specific functions. The results were positive enough to justify expansion. The path from "approved pilot" to "operational standard" is now visible, even if governance constraints slow the pace.

Regulatory frameworks adapted. US regulators confirmed that banks can intermediate crypto transactions. Pilots accept tokenised assets as margin collateral. Regulators are building frameworks for tokenised assets to function within the banking system.

Hybrid custody models emerged. Traditional banks and crypto-native firms started integrating rather than competing. The organisational distinction between "traditional" and "digital" is collapsing.

None of these alone proves convergence is happening. Together, they suggest the mechanism is becoming operational.

What convergence means

If this thesis plays out, several things follow.

Asset class expertise depreciates. The knowledge that makes someone a fixed income specialist or an alternatives administrator becomes less valuable. The operational distinctions those roles exist to manage are shrinking.

Scale economics change. Today, expanding into a new asset class requires building capability for that class. Expensive and slow. If the layer is common and AI handles workflows, expansion becomes configuration rather than construction.

The "digital assets desk" is just the beginning. The industry treats digital assets as a new asset class to support. That framing is too narrow. If tokenisation spreads, there is no separate digital function because eventually most assets are digital. The question becomes "how do we rebuild operations for a tokenised world."

This integration will not be smooth. The people who built digital assets businesses as separate empires have incentives to keep them separate. There will be turf wars. But clients do not want to pay for two operating models when one will do. The politics will slow things down. They will not stop them.

The abstraction layer model

The winning firms are building abstraction layers.

The underlying complexity of custody is not going away. Regulations differ by jurisdiction. Asset classes have different legal characteristics. Markets operate on different schedules.

What changes is who faces that complexity. In the old model, the client faced it directly, or the custodian built asset-class-specific teams. In the new model, the custodian builds a common operational layer that absorbs the complexity and presents a simple interface.

The client sees: one platform, one data model, one relationship.

The custodian manages: all the underlying variation, increasingly handled by AI agents operating on a tokenised layer.

The complexity does not disappear. It gets hidden behind a better interface.

What would prove this wrong

Tokenisation adoption stalls. If tokenisation stays confined to niche asset classes, layer convergence does not happen. If progress is CSD, by CSD, that’s a very different scenario.

AI governance proves impossible. If governance constraints prevent deployment beyond narrow use cases, workflow convergence does not happen. Yet already, firms that are using AI tools want to use them more - not less.

Regulatory fragmentation persists. If each jurisdiction requires different handling regardless of the technology, operational complexity remains. This could be the persistent value add of global custodians - handling cross-border gaps in automation.

Incumbents successfully defend. Firms built around asset class expertise have incentives to maintain the distinctions that justify their value. They may slow this wave as they slowed previous ones. They also have cash and scrip for strategic M&A of challengers.

The timeline

2025 is not the year convergence happened. It is the year convergence became plausible.

Tokenised collateral in production. AI proving itself in narrow deployments. Regulatory frameworks adapting. Hybrid models emerging. The mechanism became visible.

2026-2028 will test the thesis. Does tokenisation expand? Do AI governance frameworks mature? Do firms betting on convergence outperform those defending fragmentation?

2030 is when we will know. If convergence is real, asset class silos will have collapsed and AI agents will handle most workflows. If not, we will have another round of transformation that delivered incremental improvement.

The direction seems right. The speed is uncertain.

The strategic question

Is your firm building toward the converged model, or defending the fragmented one?

Signs you are building toward convergence:

Tokenisation treated as infrastructure, not a product line

AI deployment focused on workflows, not isolated tasks

Organisational structure moving away from asset class silos

Investment in common platforms rather than asset-class-specific systems

Signs you are defending fragmentation:

Tokenisation treated as another asset class to support

AI used for efficiency within existing processes

Organisational structure reinforcing asset class distinctions

Continued investment in asset-class-specific infrastructure

Both approaches will work for the next few years. The divergence comes later. The firms that built toward convergence will have operating models that scale. The firms that defended fragmentation will have cost structures that cannot compete.

The window to choose is now.

Custody is becoming software-defined

The custody industry spent decades building expertise around the operational differences between asset classes. That expertise was valuable because those differences were real.

Tokenisation and agentic AI are erasing those differences. Not the legal differences, but the operational ones. The work of holding, settling, and servicing assets is converging toward a common model.

2025 was the year this became visible. The next five years will determine who understood what they were seeing. None of the legal and regulatory friction that exists today may survive what hyper-competition brings all industries by 2030.

Global Custody Pro exists to map this transition: not to report it, but to explain it.

If you are interested in discussing what this means for your business, reply to this email.

Do you enjoy Global Custody Pro? Share it with a colleague today:

Deeper PFMI insights, all in one place.

RiskISR is our proprietary database of PFMI quantitative disclosures now covers 46 FMIs with selective historical depth. Coupled with our custom analytics and calculated measures, it enables sharper, more meaningful comparisons across global FMIs. If this capability aligns with your needs, contact [email protected] to discuss further.

How was today's newsletter? |

© Global Custody Pro. Published by Digital Content Operations LLC. All Rights Reserved.